GLMR Transparency Commitment

Updated as of July 31, 2025

The Moonbeam Foundation (“Foundation”) is committed to the longevity, development, and security of the Moonbeam network. We recognize that transparency is core to the sustainable success of the network. As part of this commitment to transparency, we are providing the community the following information on the Foundation’s token holdings, token actions to date and token supply.

Foundation Objectives & Statement of Use

The Moonbeam Foundation uses tokens under the Foundation control to help ensure the following three immediate strategic goals: (i) parachain sustainability, (ii) security and protocol development, and (iii) grants and ecosystem development.

(i) Parachain sustainability: the Foundation uses tokens from the “Parachain Bond Funding” and the “Parachain Bond Reserve” allocations to help ensure that Moonbeam maintains its parachain slot on the Polkadot network. Ultimately, the Moonbeam network needs to secure enough DOT to remain in a parachain slot in perpetuity. Multiple strategies will be employed by the Foundation to assist the Moonbeam network to achieve this DOT accumulation goal including, but not limited to, community token events to borrow DOT, deposits into and use of Moonbeam-based defi protocols, and potential liquidations of tokens for DOT. On June 8, 2023, the Moonbeam Foundation bid on and won a slot in the 44th Polkadot parachain auction for the July 31, 2023 – June 5th, 2025 lease period. Upon the expiration of this lease, Moonbeam officially transitioned to Agile Core TimeGo to page https://polkadot.com/agile-coretime to maintain its parachain on Polkadot. Excess funds may be re-allocated toward other strategic goals and/or operational needs.

(ii) Security and protocol development: the Foundation uses tokens from the “Long-Term Protocol & Ecosystem Development” allocation for a variety of initiatives that help ensure network security and that help drive the network’s long-term utility. These include supporting security audits, core protocol development, integration and testing of parachains and remote chains, infrastructure related test and integration environments, public RPC endpoint services, block explorers, developer support, education, and documentation. The Foundation encourages teams that can provide these kinds of services to apply via the Grant Program or through the Treasury.

(iii) Grants and ecosystem development: in addition to the “Developer Adoption” program designated as pre-launch incentives for early Moonbeam adopters, the Foundation also uses tokens from the “Long-Term Protocol & Ecosystem Development” and the “Liquidity Programs” allocations to attract cutting-edge teams and builders to Moonbeam through cash or token grants, competitions, incentive programs, ecosystem investment funds, and an accelerator program. Through the end of July 2025, the Foundation has disbursed over 40.1M GLMR from the Liquidity Programs allocation and 20.5M GLMR from the Developer Adoption allocation as token grants, jointly funded the Arrington Moonbeam Growth Fund (Long-Term Protocol & Ecosystem Development allocation) and Moonbeam Accelerator Program with Arrington Capital to support the developing ecosystem, and has disbursed $6.5M as fiat and stablecoin grants to selected projects and teams. Selection for these initiatives is based upon a myriad of factors including the team’s technical capabilities, their product innovation, and community engagement.

In order to achieve these stated objectives:

- The Foundation may re-balance Foundation-controlled accounts from time to time, creating new addresses or removing old addresses. Any update to account addresses will be reflected below in order to ensure transparency.

- The Foundation may liquidate GLMR from time to time, when expenses cannot be paid in GLMR. A prime example would be liquidating GLMR in order to accumulate DOT for parachain sustainability purposes as described above. When undertaking these activities the Foundation will strictly adhere to the following Structured Selling Guidelines:

- The seller only makes offers above market price, and doesn’t sell into bids.

- Daily sales remain materially below a fixed amount set based on medium term volumes, and with the constraint of remaining below 5% of estimated real market volume on any given day.

Genesis Addresses Under Foundation Control

The Foundation has published below the non-circulating and circulating genesis addresses of the tokens held under Foundation control for the community to monitor.

Non-Circulating Addresses:

0xec5849f7b9f7b5188e53e6546d07062b7d2b46a0

0xe15a2e4f35215a553151df283a39c7d17db8aaec

0xee050f48ff5ff71604d5ca32020a6ba1c070f1b2

0x3ad24a37d4b6ebd24e70a2c87241a63d92a6b288

0x835d6f7b649e109470f966a936308f78fdebec2d

0x02f50d4c3861c279aa0467caf49f8077b3c0ca60

0xce216241675657f40203679aa8f6472d8c140ab0

0xf1e35633ebbb793f1d22e6cc6b279afe8c33b381

0x906ea348769389c32f2732b79615d12b2514274e

0x91ad9c2608d04722400a22215d2d951dedb11cb4

0x6e87680133c34c96c86ffd101844b14fd63f0fe1

0xe51df5c29bfe022854fde7ebc4b06a6cdb94b60e

0x98091cad1243f4a6d2454a7f0ca3258fb053c152

0xb29f4d175953faf999869036bb170e4a99dba62c

0x0344cb6a7acb0f074237943e2ffb0bfce6e6c1fc

0xfb43cc3136a81d6df94b92637b007f0235b92563

0x418671c5e8e14095720bae1f063df18c6414239b

0xaab463ba7bf4eca75d5f84aabfb077dc9b9fbf0c

0xa99716fdf1a1e45969cc5469f3fadec7c3b4666f

0x72990280c6e37995f5a7446d7d420eb7bcd8ffa8

0xc6956173029911a93483e00ec4c5378f1aaf37f1

0xd0ae4f927db4d4adf162336f4f088b02f24f7e09

0x3628e309c5b745eb35f92bcf81fc6f9794e0f15c

0xa9349a0191c93534f8b9ca295ebf2b8a87c89062

0x6f39cba057acb67df748efce6d14b94c53b16574

0x41f666ac944a4613df26d00a5d3926e64574a6be

0xef24bcef8052cf5f2758ea23ed02d48c0f788bd5

0xd985dd9453bb9bae5f2bcb79f90b3ed724033ca0

0x47b69aef78183b282c6dfad76eecfcd0676a85f3

0xb00af4494099bf419c79768cc3d2e1f45a106b54

0x7882fc72720e2bd786dc1e2dda3b37f76ef7ac1a

0x2afbdaeed55af511d2f4f54048db5347993c41d1

0xb49e71e2516084f4697e21b7f2ebeddbfc900887

0xe5a56b7ff1aa39376588968e057f73ba9dc43ac1

0xb843fa0c53382a24386c4bfd6e26156b6c1aa502

0x286c93de3767bdc37694ff5326a2ec074a271841

0x4599d3fb61afbe53ec0c74e9d3e662df14c011bc

0x18cb64d0d2b5cecb7d0f08e4bec9c955f3a221ed

0xeee7f269e04163dea8f9c8c075429e0b9928a6f8

0xbfa14eb753e03ec28f1fca98e60227f1e3631451

0x471ac074b60dab1ce62eec90b766a7e3da5719bf

0x85b46641d2f1c1c207d50c1d0e04f8e57c8cf2f8

0x7f8d1c2b3d770693a4c0ebc02731dc3107bca672

0x670762abc78c65aee1274bc2ed179da7b8bd3b81

0x7f1ba0b92943a38a55ea344676f5685afbfe5ad5

0xac6d13f8b148acfc5fca4d4d6b4eaa5a78c6079c

0x365cb79b68552a44ecce2cfc698de5edfaf452c0

0x93041c0aa0b6e96c4e5f98831c58673f2e318274

0x0a2f88f2c8ec33ab7d5118a09b09eef844e3be72

0x49700fb3ddb67d7f7e366261fcbdfac0b90f6f5a

0xb2e3e0b8cecfbd8b4f3dc1849ddf3c79c21300bd

0x5a97a6f687d7c76d3ea7563a60cc615c6c939d54

0xcb95c0e6fcce0e78f62f7f809ab5ec161722fa17

0x97292e7fb192323faa3490fb084c1a450278206c

0x9c2284cbbeaacf3fae4aea80ad5d690f4c40fec6

0x734bbb2d0b28b36fac6de190978a54f294199f98

0xf1d1587678f6eb30b7c7a9773268b952a4b3e29f

0x0af55f1f6daf6efa8ebec64965120fd4053b1017

0xa5577da5f45aa886ce77f46e93a52802dba556f9

0x8ebb465d98e7589855485cd190c7bed6a36c4c34

0xfc02d8861d624d89e1c4c364a5d534aed0e75b45

0x10a75c8b30543dae7ff2ed6704c1bf769b3376b5

0x0dfd2741fa7f5e6a22b1c7fb13c3554550ecc9d5

0x02a28a296dfc6be50199e6a877b0b981055da8e7

0x5489fd1637f76c6f11198a06a1dc05a7f1f7e629

0xbc9429cbfa409ebfa9ba218f2c02eeda1e4a5203

0xd749a1c1a2b538609c722872637ac23bb4df6514

0xeace0fb4d9051d5c1d006a6953caa7e7ca140481

0xa4d9ac2893f430ad101d9691d9587be24f30aed9

0xda5531c9329426F4f3d4051291D98947F219ae20

Circulating Genesis Addresses:

0xb3e64ef8fc9df438c9a54f4b189eddc1807b55a5

0x01bb6ce8b88f09a7d0bfb40eff7f2ad5e0df2e98

0xe751b9ea560a200161d1b70249495e3d22ec5b00

0xf02ddb48eda520c915c0dabadc70ba12d1b49ad2

0x84e84c5b3f0fd7d6edea829653787a8b9cb92783

0x7368ef98577a419280974a60e7fe590379c21e6a

0x71a30f3b36e29ac78f3e94f446b938f19f0b40e7

0xf21cdd2f90c4d450bd27e01a3453bf346e6b4958

0x06ac5fe4eee12a35e996571ef1f72ea237eec806

0x8134502ddcd2598d8f40f7b35a59c77c6bff1f6a

0xcfbf79a75a35baa595b7e0d376c87fa47f6ef3da

0x2719c3b290189dc43abd179a35a438dc2baa47e3

0x948cdcf0102d948fd391256682d666e52ce65e86

0x23e8a745062874355f391acf4677fc69bdc52626

0x98C5eeCffdb6c8eE3c18f6FBD8E498763bB40b83

Protocol Controlled Addresses

Crowdloan Pallet Funds:

0x6d6F646C43726f77646C6f610000000000000000

Treasury:

0x6d6f646C70792f74727372790000000000000000

State of GLMR Supply as of July 31, 2025

Circulating Supply: 996M

Total Supply: 1,185M

Gross Inflation: 188.7M

Net Inflation: 185.3M

Burnt Fees: 3.3M

As of July 31, 2025, total GLMR supply was 1.185B, consisting of 1B genesis supply and 185.3M cumulative net inflation (defined as newly minted inflationary GLMR less burned transaction fees). Cumulative gross inflation totaled 188.7M through July 31, 2025, reflecting a 4.77% annualized increase over genesis supply of 1B on a compounded interest basis (5.21% using a simple interest basis). Actual gross inflation for the six months ended July 31, 2025 was 4.83% relative to genesis supply on a compounded basis, which was in line with the annual inflation rate target of 5%.

Since the launch of the network, approximately 132.0M tokens have been minted and distributed to collators and delegators in the form of inflationary protocol rewards consistent with GLMR’s inflation model. Collators and delegators are integral to the security and sustained operation of the network and, as such, earn a proportionate share of the supply’s 5% target annual inflation rate for their network contributions (approximately 20% and 50%, respectively).

To ensure long-term parachain sustainability, a portion of Moonbeam supply inflation is also designated to the parachain bond reserve to ultimately secure a Polkadot parachain slot in perpetuity. 30% of supply inflation was being directed to the parachain bond reserve from network launch until January 22, 2025 when this was reduced to 6% via Moonbeam Referendum #90Go to page https://apps.moonbeam.network/moonbeam/referendum/90. (The remaining 24% of supply inflation is now directed to the on-chain treasury). The parachain bond reserve has grown by approximately 56.6M GLMR since the launch of the network via its proportionate share of supply inflation.

In line with GLMR’s token economic model, a percentage of transaction fees related to smart contract execution are burned and removed from token supply. Until March 13, 2025, 80% of fees were burned with the other 20% of transaction fees allocated to the community on-chain treasury. With the enactment of MB 101Go to page https://apps.moonbeam.network/moonbeam/referendum/101 on March 13, 2025, the percentage of fees burned was increased to 100%. In addition, with the upgrade to RT3501Go to page https://apps.moonbeam.network/moonbeam/referendum/102 on March 17, 2025, the EVM priority fee is no longer burned but rather directed to the block author to be inline with Ethereum's fee model. As of July 31, 2025, 814k GLMR have been allocated to the treasury through its proportionate share of transaction fees.

Approximately 84.0% of total GLMR supply has been released into circulation as of July 31, 2025, which is further detailed in the following sections.

Glossary:

- Circulating Supply: all tokens that are held in accounts outside of the non-circulating Moonbeam Foundation and protocol-controlled addresses listed above.

- Circulating supply includes circulating accounts under Moonbeam Foundation control (listed above) such as collator and other operational accounts that were classified within the Long-Term Protocol and Ecosystem Development allocation. The combined total genesis balance of these accounts was released into circulating supply at network launch.

- Total Supply: the number of tokens that are (i) circulating, (ii) under the Moonbeam Foundation control, (iii) under the Protocol Control

Tokens Released Into Circulation

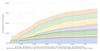

Historical Token Release Since Network Launch(1)(2)

- Token release schedules are approximate and subject to change. Please refer to https://moonbeam.foundation/glimmer-token-tokenomics/ for information on token allocations and please see the information below for further detail on the release of tokens.

- Forecast token releases for allocations are not included in the figures above. As such, only historical activity is presented from network launch through July 31, 2025 for the selected allocations in the chart.

The net release of GLMR into circulation from select non-circulating genesis allocations is reported on a cumulative basis since network launch as well as for the subject 6-month reporting period. Going forward, updates to the transparency pages will continue to be bi-annual.

Genesis Allocation | GLMR Net Released 2/1/25-7/31/25 | Cumulative GLMR Net Released at 7/31/25 |

Crowdloan 2021 | 0 | 150.0 million |

Take Flight | 0 | 98.2 million |

Developer Adoption Program | 0.1 million | 20.5 million |

Liquidity Programs | 2.3 million | 40.1 million |

Long-Term Protocol & Ecosystem Development | 7.3 million | 110.3 million |

Seed Funding | 0 | 140.0 million |

Strategic Funding | 0 | 120.0 million |

Key Partners & Advisors | 0 | 39.5 million |

PureStake Early Backers | 0 | 14.0 million |

Founders and Early Employees | 12.5 million | 87.5 million |

Future Employee Incentives | 4.7 million | 38.4 million |

Treasury (on-chain community treasury) | 418 thousand | 2.7 million |

- Crowdloan 2021: 150M GLMR was allocated to the Moonbeam 2021 Crowdloan, of which 30% was distributed at network launch (when transfers and EVM were enabled) and the remaining 70% vested linearly over the 96 weeks of the parachain lease. Crowdloan rewards became fully vested in October 2023. Of the 150M total vested, an estimated 8.3M GLMR remained unclaimed as of July 31, 2025.

- Take Flight: The 98.2M GLMR tokens that were allocated to community members during the Take Flight token event (September 2021) were disbursed in full to participants on February 20, 2022.

- Developer Adoption Program: Cumulatively through the end of July 2025, the Foundation has distributed 20.5M GLMR from this allocation and an incremental $6.5M from its cash and stablecoin reserves as developer grants to 124 project teams as contractual milestones have been achieved. Of note, the majority of GLMR grants are subject to 24-month linear vesting schedules beginning on the date of milestone achievement and, therefore, will be released gradually over the two year vesting horizon (rather than as a single disbursement).

- Liquidity Programs: Approx. 80.3% of the 50M total Liquidity allocation, or 40.1M GLMR, has been distributed in the form of liquidity grants through July 2025. Of the 40.1M cumulative total, 2.3M GLMR was released to one grant recipient over the last 6-month period.

- Long-Term Protocol & Ecosystem Development: As of the end of July 2025, the Foundation has released 110.3M GLMR from the designated Long-Term Protocol & Ecosystem development allocation, of which 7.3M was released during the last 6-month period. Of the 7.3M total, 5.1M GLMR was transferred to a third party provider for liquidation under the structured selling guidelines outlined above. Sales proceeds have been used to build operational cash reserves to cover future expenses and to fund fiat and stablecoin grants, daily operations, and other network expenses. Other Long-Term Protocol & Ecosystem Development tokens were used to compensate Moonbeam Foundation employees and advisors. In support of the Orbiter program, the Foundation also operates one of its Long-term Protocol non-circulating addresses as a network delegator. This account earned delegation rewards of 402k GLMR during the 6-month period, which were sent to the community-governed Treasury for the benefit of the overall network. Since the delegating account is non-circulating, all earned rewards effectively remain in non-circulating supply upon receipt. Delegation rewards earned by this account will continue to be swept to the Treasury on an ongoing basis.

- Seed Funding: The 140M Seed Early Backer allocation was subject to an initial 3-month lock-up with equal unlocks in months 3-24. The first distribution took place on April 11, 2022 and, through the end of July 2025, all 140M GLMR has been distributed to Seed Early Backers.

- Strategic Funding: The 120M Strategic Early Backer allocation was subject to an initial 2-month lock-up with equal unlocks in months 2-12. The first distribution took place on March 11, 2022, and the final distribution took place on January 11, 2023. As such, the full 120M GLMR allocation has been fully distributed to Strategic Early Backers.

- Key Partners & Advisors: The approx. 39.5M allocation consists of advisor and partner allocations that are subject to various unlock terms. Seed partners were subject to an initial 3-month lock-up with equal unlocks in months 3-24 (included in “Seed Terms” allocation in the preceding token release chart). Strategic partners were subject to an initial 2-month lock-up with equal unlocks in months 2-12 (included in “Strategic Terms” allocation in the preceding token release chart). Strategic partners received their final distributions in January 2023. Most other advisors were subject to an initial 7-month lock-up with equal unlocks in months 7-24. As of July 31, 2025, all 39.5M GLMR has been distributed to partners and advisors.

- PureStake Early Backers: 14M GLMR tokens were allocated to early backers of PureStake, a core contributor of the Moonbeam Network. Vesting terms mimic those of most non-Seed and non-Strategic Advisors, as allocations are subject to an initial 7-month lock-up with equal unlocks in months 7-24. Through the end of July 2025, all 14M GLMR have been distributed to Early Backers.

- Founders & Early Employees: Founders and early employees of PureStake, a core contributing team to the Moonbeam network, were allocated 100M GLMR subject to a 4-year vesting schedule from network launch with a 1-year cliff and monthly vesting thereafter. Cumulative distributions through July 31, 2025 totaled 87.5M and will continue monthly according to the defined vesting terms.

- Future Employee Incentives: Existing and future employees of PureStake were allocated 46M GLMR subject to a 4-year vesting schedule from network launch or grant date (whichever is later) with a 1-year cliff and monthly vesting thereafter. Cumulative distributions through July 31, 2025 totaled 38.4M and will continue monthly according to the defined vesting terms.

- Treasury: Pursuant to the Treasury Spend ProgramGo to page https://forum.moonbeam.network/t/referendum-mb92-mr7-status-passed-moonbeam-treasury-program-renewal-april-2023/786, the Moonbeam Community Treasury Council awarded 8 Treasury ProposalsGo to page https://moonbeam.subscan.io/treasury totaling 418k GLMR from February 2025 through July 2025 (visible as Treasury Proposals in the Subscan blockexplorer). As previously mentioned, the Foundation also operates one of its non-circulating genesis addresses as a network delegator in support of the Orbiter Program. Since the delegating account is non-circulating, all earned rewards effectively remain in non-circulating supply and are sent to the Treasury. Through the six months ended July 31, 2025, 402k GLMR rewards earned via this delegation account were swept to the Treasury. In addition and as described above, as of January 22, 2025 (Referendum #90Go to page https://apps.moonbeam.network/moonriver/referendum/90), 24% of supply inflation began flowing into the Treasury resulting in 6.8M GLMR being added during the reporting period. As such, inflows to the Treasury will exceed the designated 20% share of transaction fees.